rsu tax rate calculator

See reviews photos directions phone numbers and more for Tax Rate Calculator locations in Edison NJ. An RSU taxation example.

Restricted Stock Units Jane Financial

Vesting Schedule Hypothetical Future Value Per Share.

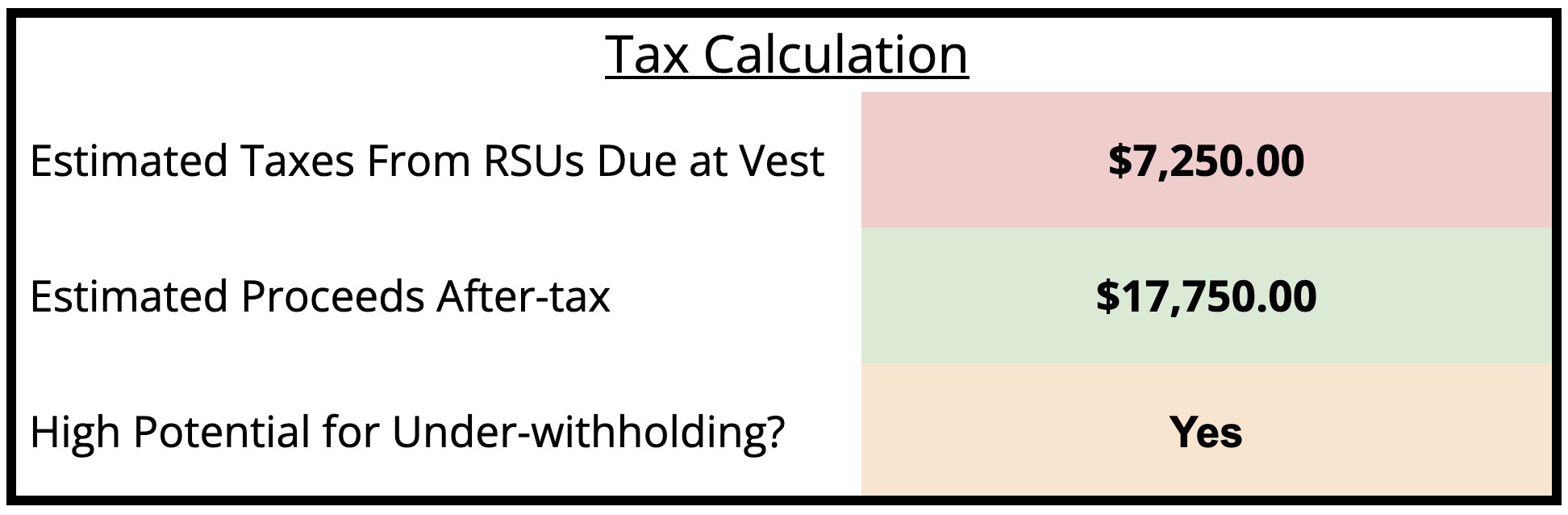

. RSUs are taxed at the ordinary income rate and tax liability is triggered once they vest. What Are Restricted Stock Units. This online calculator allows you to estimate both federal and state taxes due to an IPO or vested RSUs and is especially useful as it takes into account capital gains deductions and existing tax withholdings showing you the additional taxes due that you may need to prepare for.

Basic Info for RSU Calculator. Vesting after Social Security max. This is different from incentive stock options which are taxed at the capital gains rate and tax liability is triggered when the options are exercised.

If you live in a state where you need to pay state income taxes repeat steps 2 and 3 using your state marginal tax rate. The beauty of RSUs is in the simplicity of the way they get taxed. Please feel free to enter specific property.

Vesting after Medicare Surtax max. Water treatment plants and recreational parks with all counting on the real property tax. If rates are low think about a mortgage refinance.

Extra tax of 4310 due to loss of personal allowance as income above 100000 employee nic 2 431. From there the RSU projection tool will model the total economic value of your grant over the years. Enter details of your most recent RSU grant your companys vesting schedule and some assumptions about your tax rate and your employers future returns.

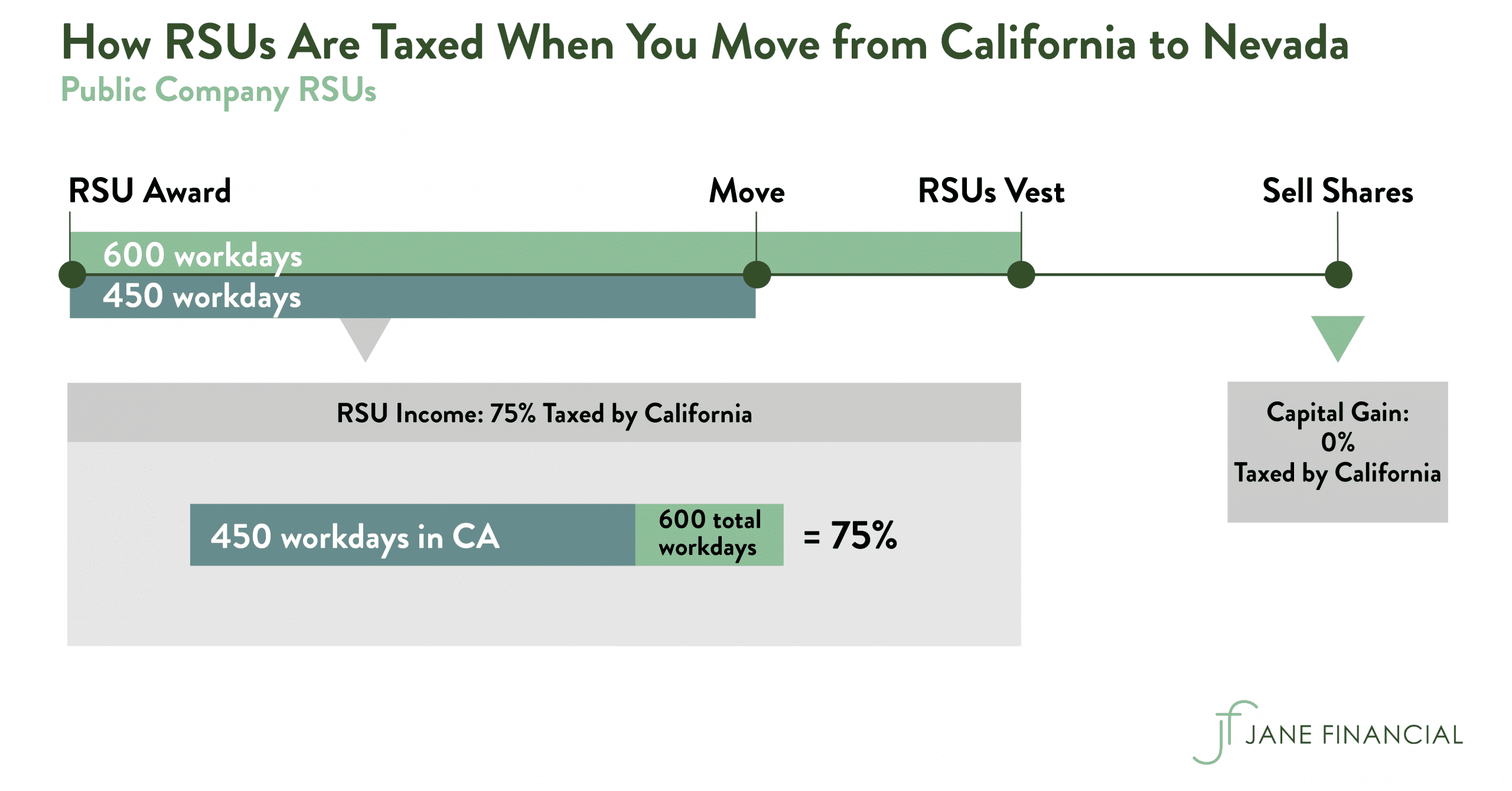

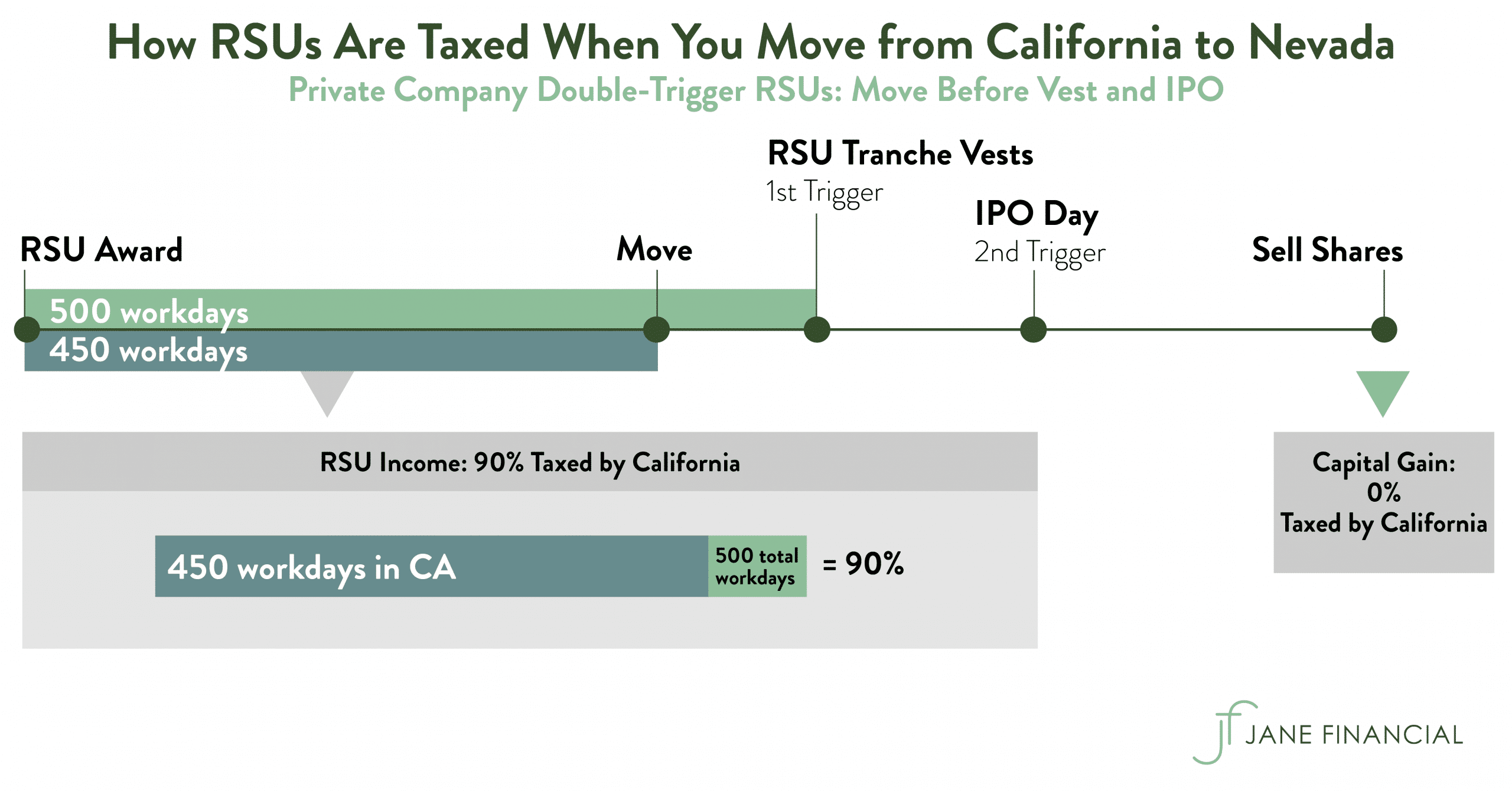

Marginal Federal Tax Rate You can use the 2020 brackets below to estimate your tax bracket. Sales price price at vesting x of shares Capital gain or loss. RSUs resemble restricted stock options conceptually but differ in some key respects.

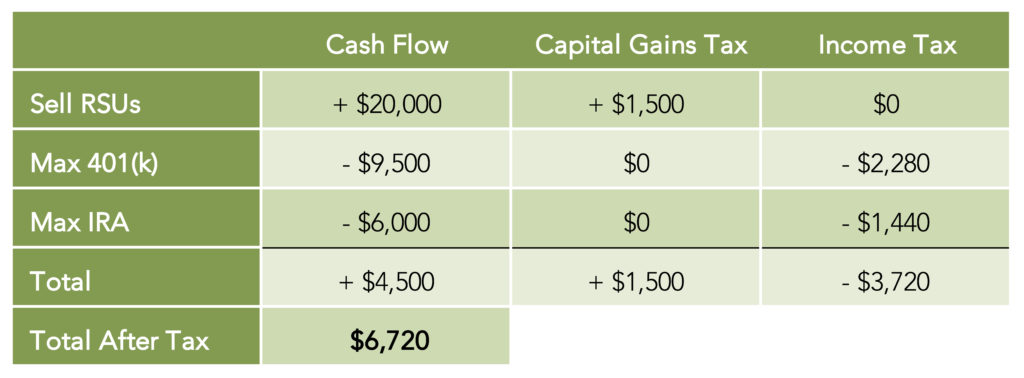

Long-term capital gains are taxed at a special lower rate. A app to help calculate how much tax you pay on RSUs A app to help calculate how much tax you pay on RSUs. The of shares vesting x price of shares Income taxed in the current year.

RSU taxes can be complicated. For academic purposes. Vesting after making over 200k single 250k jointly.

In reality the difference is the rsu taxes left. Not only for counties and cities but also down to special-purpose units as well eg. On this page is a Restricted Stock Unit Projection calculator or RSU calculator.

For most people the tax rate on long-term capital gains is 15. June 20 2022 June 20 2022. If the rsus take you over 100000 you will pay income tax at a marginal rate of 60 plus the employers national insurance.

Vesting after making over 137700. Restricted Stock Units RSUs Tax Calculator Apr 23 2019 0 Hope. The timing of RSU tax is exactly the same as any other.

Therefore the possibility of the overpayment is minimum in the case of RSUs. Again real property taxes are the single largest way Piscataway pays for them including over half of all district school financing. For high earners the capital gains tax rate is anywhere from 188 to 238.

Here is an article on employee stock options. The calculator primarily focuses on Restricted Stock Units RSUs. 64 to the tax rate of your state to find out what percentage you are paying in taxes.

Here are the things you need to understand about restricted stock units or RSUs and its tax treatment. If youre a single filer with 175000 taxable income youre at a 32 marginal tax rate. RSUs are taxed as W-2 income subject to federal and employment tax Social Security and Medicare and any state and local tax.

Sign in with Google. We use state and national averages to estimate your property taxes. Inflation interest rates take toll on bond markets.

Unless the RSU fits within an exception an employee pays tax on an RSU when he receives a unit the right to receive cash or shares as compensation. Change the variables on the above calculator to see the monthly payment on a different loan amount. Unlike the much more complicated ESPP they get taxed the same way as your income.

RSUs can also be subject to capital gains tax but this. Speak with a local lender at a bank as well as getting online quotes to get the best available rate. If you keep them for more.

Youll be taxed at the short-term capital gains tax rate if you keep your shares for less than a year. 15 and 30 year mortgage terms are most common for fixed rate mortgages. As central banks tighten a portfolio manager explains the risks and outlook By.

RSU tax at vesting date is. How to Calculate Quarterly Estimated Taxes for 2021-2022. Multiply the tax rate from 2 by the gross value of the RSUs that vested and subtract the amount that was already withheld by your employer.

Use our calculator to receive a rough estimate of your costs. You may also choose adjustable rate mortgage which almost always come in a 15 or 30 year term. Our Premium Calculator Includes.

New Jersey Tax Deductions Income tax deductions are expenses that can be deducted from your gross pre-tax income. See mortgage interest rates and calculate payments for Piscataway Township NJ. RSU Tax Treatment Key Dates.

If held beyond the vesting date the RSU tax when shares are sold is. - Compare Cities cost of living across 9 different categories - Personal salary calculations can optionally include Home ownership or rental Child care and Taxes with details on state and local sales income property and automobile taxes - Includes the cost of Child Care for toddlers or infants at a day. Eddy Engineer has 1000 shares that vest in April of 2022.

RSUs represent an unsecured promise. How Are Restricted Stock Units RSUs Taxed. Some states have capital gains tax as well.

Rsus Can Also Be Subject To Capital.

Rsu Tax Rate Is Exactly The Same As Your Paycheck

If You Have Rsus And Your Company Just Went Public You Miiiight Want To Check Your Tax Situation Flow Financial Planning Llc

Rsu Taxes Explained 4 Tax Strategies For 2022

Restricted Stock Units Jane Financial

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

Rsu Taxes Explained 4 Tax Strategies For 2022

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

Rsu Taxes Explained 4 Tax Strategies For 2022

Restricted Stock Units Rsus Tax Calculator Level Up Financial Planning

When Do I Owe Taxes On Rsus Equity Ftw

Rsu Calculator Projecting Your Grant S Future Value

Restricted Stock Units Jane Financial

When Do I Owe Taxes On Rsus Equity Ftw